| CEO Letter |

Dear Shareholders:

West celebrated a significant milestone in 2023—our 100thyear in business—an accomplishment achieved by only a few select companies. This milestone provided our Company the opportunity to reflect on our rich history and the impact we have made through the relentless pursuit of tremendous growth forour purpose to improve patient lives through the packaging and delivery of injectable therapies. Looking ahead to the next century, West is well positioned to not only sustain but enhance our critical role in healthcare as we continuedcontinue to demonstratework by the side of our commitment to improving patient lives during the second year of the pandemic. As our industry worked to resume as much normalcy as possible to address ever-present, underlying healthcare conditions and diseases, West remained steadfast in our approach. We partnered with our biopharmaceutical and medical device customers to help them developserve the patients who rely on our products and deliver novel treatment optionsservices.

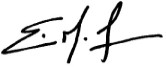

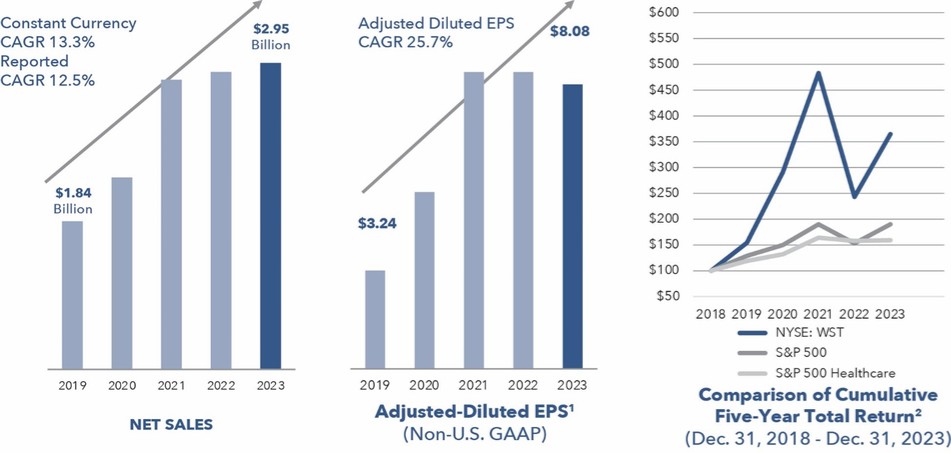

We had strong 2023 base organic sales growth, excluding the headwinds from lower pandemic-related sales, led by high-value product components and vaccines to fight both COVID-19device and the myriadcontract manufacturing. Our overall 2023 net sales of routine diseases that patients continue to face.

As we look to the future, we are making significant capital investments in our already strong global operations footprint to enable additional capacity for the increased customer demanddemand. In February, we opened a new research and development lab in Radnor, Pennsylvania, where our research focus will expand to fulfill ongoing commitments which enabled usinclude containment and systems for advanced therapies and biomaterials, alongside development and testing for elastomer-glass systems, containment and packaging options. These investments, together with a strong and growing portfolio of products and services, will fuel organic sales growth and margin expansion, allowing West to increase product delivery associated with the pandemicreach more patients and growdeliver value back to shareholders.

Our commitment to responsible business practices remains steadfast and I am proud to report that West has once again been recognized for our core business.

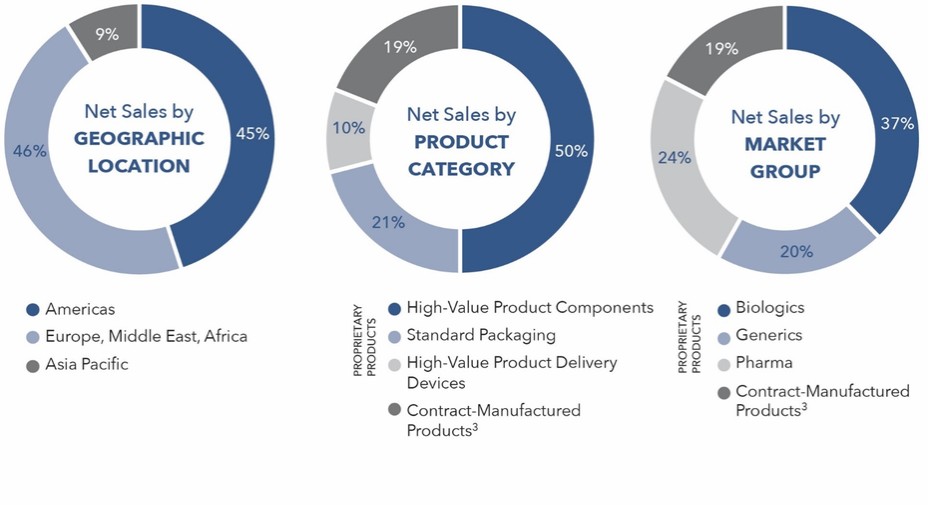

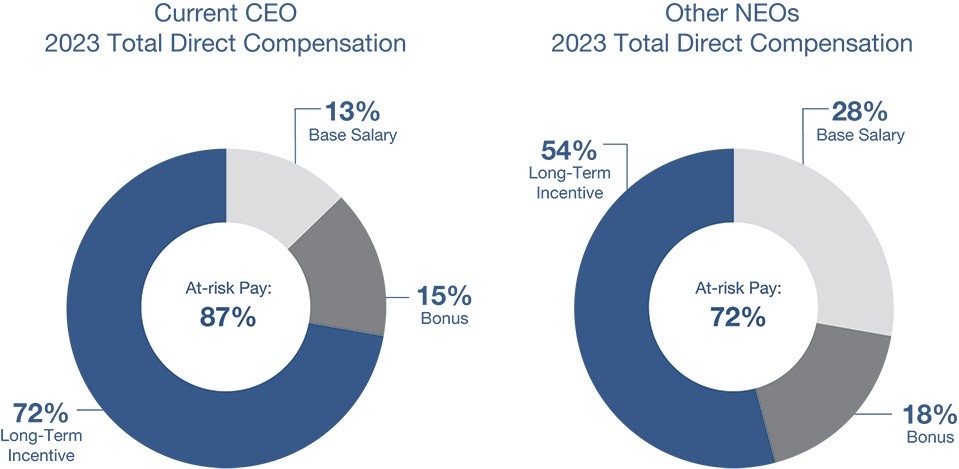

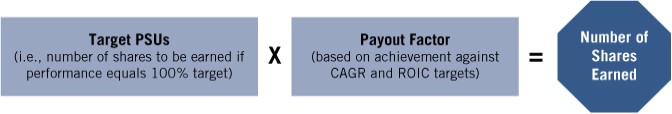

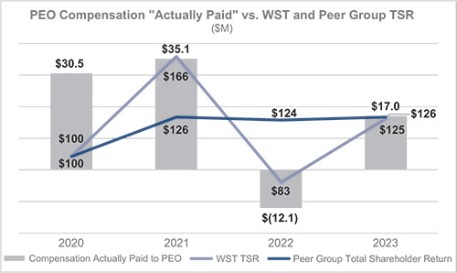

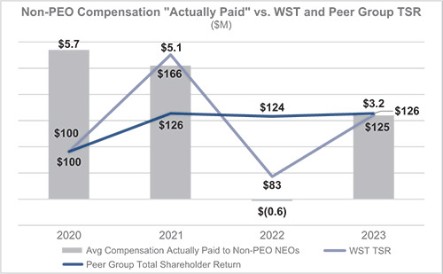

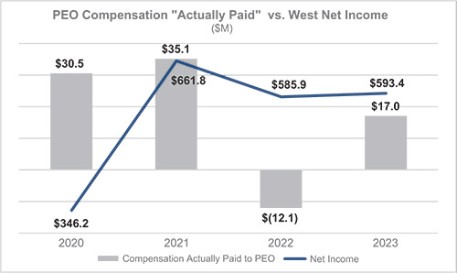

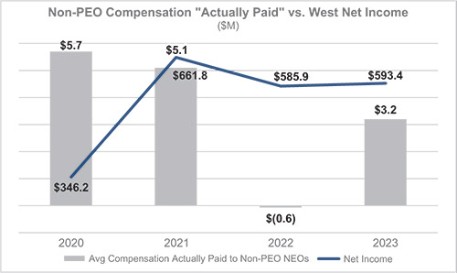

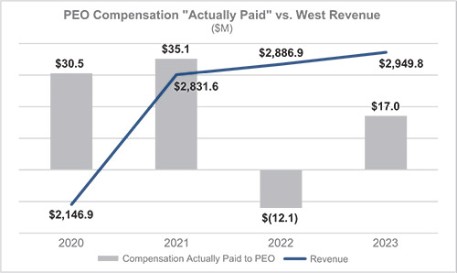

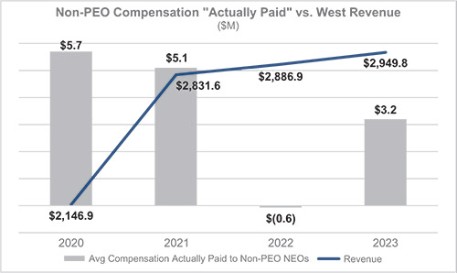

As in years past, the Management team, has worked togetherin collaboration with the Board of Directors, continues to ensure theuphold our commitment to aligning team performance of our team is reflected in theirwith compensation and awards framework and is aligned with the business results we have delivered. The detailedawards. Our transparent pay-for-performance plans offor our executives which in the past have receivedhas continued to receive more than 95 percent support from you, our shareholders, areas detailed in this Proxy Statement.

Over the course of our 100 years in business, we have grown from manufacturing rubber and in 2021, our Board welcomedplastic solutions to designing and producing smart medical systems, critical to the delivery of today’s most advanced injectable therapies. As a new member, Molly Joseph, former CEOglobal market leader, West is defining the evolution of UnitedHealthcare Global, and also preparedan industry that will continue to bring about a healthier world for the announced retirement ofpatients we serve. We remain grateful to all our 2021shareholders who have supported West along the way and to those who join us in looking forward to West’s future.

Eric M. Green

President, Chief Executive Officer and Chair of the Board Patrick Zenner. For the past 20 years, Pat has been an instrumental member

![[MISSING IMAGE: tm223484d1-bc_growpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/tm223484d1-bc_growpn.jpg)

![[MISSING IMAGE: tm223484d1-pc_directrpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/tm223484d1-pc_directrpn.jpg)

![[MISSING IMAGE: ph_markbuthman-bw.gif]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/ph_markbuthman-bw.gif)

![[MISSING IMAGE: ph_williamffeehery-bw.gif]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/ph_williamffeehery-bw.gif)

![[MISSING IMAGE: ph_robfriel-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/ph_robfriel-bw.jpg)

![[MISSING IMAGE: ph_ericgreen-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/ph_ericgreen-bw.jpg)

![[MISSING IMAGE: ph_thomashofman-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/ph_thomashofman-bw.jpg)

![[MISSING IMAGE: ph_mollyjoseph-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/ph_mollyjoseph-bw.jpg)

![[MISSING IMAGE: ph_deborahkeller-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/ph_deborahkeller-bw.jpg)

![[MISSING IMAGE: ph_mylagoldman-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/ph_mylagoldman-bw.jpg)

![[MISSING IMAGE: ph_dougmichels-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/ph_dougmichels-bw.jpg)

![[MISSING IMAGE: ph_paolopucci-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/ph_paolopucci-bw.jpg)

![[MISSING IMAGE: tm223484d1-pc_ceoneopn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/tm223484d1-pc_ceoneopn.jpg)

![[MISSING IMAGE: tm223484d1-fc_payoutpn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/tm223484d1-fc_payoutpn.jpg)

![[MISSING IMAGE: tm223484d1-fc_psupn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/tm223484d1-fc_psupn.jpg)

![[MISSING IMAGE: tm223484d1-cov_pg4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/tm223484d1-cov_pg4c.jpg)

![[MISSING IMAGE: tm223484d1-px_page01bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/tm223484d1-px_page01bw.jpg)

![[MISSING IMAGE: tm223484d1-px_page02bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-045728/tm223484d1-px_page02bw.jpg)